- Definition of insolvency in a fraudulent conveyance how to#

- Definition of insolvency in a fraudulent conveyance professional#

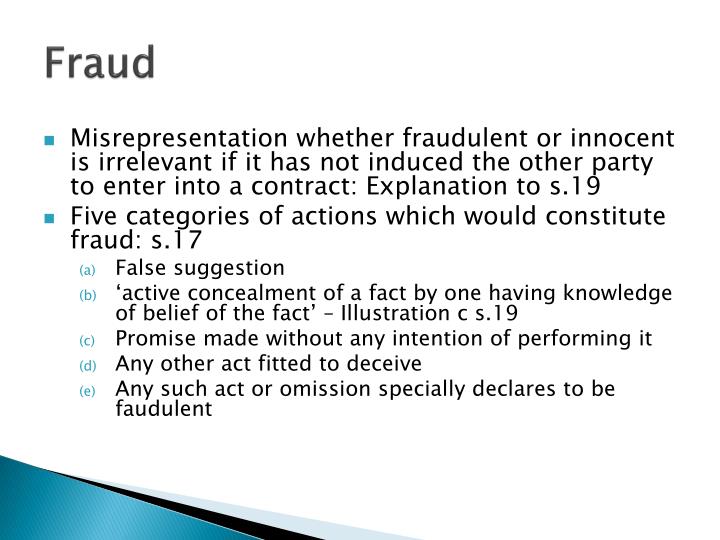

“Fair consideration” is provided in exchange for property or an obligation if: Under the constructive fraudulent conveyance statute of the UFCA,Įvery conveyance made and every obligation incurred by a person who is or will be rendered insolvent by it is fraudulent as to creditors without regard to his actual intent, if the conveyance is made or the obligation is incurred without a fair consideration. At this point in New York, there is little ambiguity on what good faith means in the constructive fraudulent conveyance context when insolvent businesses are moving money and assets. New York and Maryland are the only jurisdictions still applying the UFCA (most other states-43 of them-have moved on to the modernized Uniform Fraudulent Transfer Act), and not surprisingly, New York courts have spilled a lot of ink interpreting and articulating the rights of creditors seeking to void fraudulent conveyances. Yet what explains Maryland’s aversion to interpreting it-or acknowledging it-in the “fair consideration” definition in the Uniform Fraudulent Conveyance Act (UFCA)? No doubt, courts and factfinders have grappled with it for centuries. The law’s definition of “good faith” is often amorphous, fact specific, and difficult to spell out.

We can help if you’re still having trouble balancing your budget or managing your assets. Also manage any debts by working with creditors to negotiate reasonable repayment plans.

Definition of insolvency in a fraudulent conveyance professional#

Work with a professional estate planner and be sure to reveal everything about your financial situation that might be relevant to building a creditor-resistant plan. Build a Better Planīesides knowing the law, you can protect your estate plan in several ways. Therefore, you should consult an attorney about the law where you live. Also keep in mind that fraudulent transfer laws vary from state to state. Even if you’re not having trouble paying your debts, it’s possible you might meet the technical definition of insolvency. To avoid this risk, calculate your net worth carefully before making substantial gifts. This means a creditor could potentially undo the transfer. If you’re insolvent at the time, or the gift you make renders you insolvent, you’ve made a constructively fraudulent transfer. When you make a gift, either outright or in trust, you don’t receive reasonably equivalent value in exchange. So before you make gifts or place assets in a trust, consider how a court might view the transfer.Ĭonstructive fraud is a greater risk because of how insolvency is defined and gifts are made. A court can’t read your mind, and it will consider the surrounding facts and circumstances to determine whether a transfer involves fraudulent intent. When it comes to actual fraud, you may not be safe just because you weren’t purposefully trying to defraud creditors. Generally, constructive fraud rules protect only present creditors or those whose claims arose before the transfer was made or obligation incurred. You’re presumed to be insolvent if you’re not paying debts as they become due.

“Insolvent” means that the sum of your debts is greater than all of your assets, at a fair valuation. Under UFTA, a transfer or obligation is constructively fraudulent if you made it without receiving a reasonably equivalent value in exchange for the transfer or obligation and you either were insolvent at the time or became insolvent as a result of the transfer or obligation. This is a more significant threat for most people because it doesn’t involve intent to defraud. This means making a transfer or incurring an obligation “with actual intent to hinder, delay or defraud any creditor,” including current creditors and probable future creditors. The law allows creditors to challenge transfers involving two types of fraud: Most states have adopted the Uniform Fraudulent Transfer Act (UFTA).

Definition of insolvency in a fraudulent conveyance how to#

Here’s how to keep your estate plan from running into trouble.

In some circumstances, creditors can challenge gifts, trusts and other strategies for leaving assets to heirs as fraudulent transfers. If you have an estate plan and also have creditors, you could be a fraud perpetrator - without knowing it or intending to defraud anyone.

0 kommentar(er)

0 kommentar(er)